Introduction

Unbound Finance is a decentralized cross-chain liquidity protocol that is integrating the derivative layer of Automated Market Makers (AMM). The intent of Unbound is to build products that are both native and composable to the DeFi ecosystem. These include

- Synthetic Assets including a Stablecoin(UND), uETH,etc

- AMM pools that are cross derived from multiple AMMs

- Oracle Price Feeds based on free markets and path independent value discovery.

- Building financial instruments for compounding yields and margin trades

Unbound protocol is building a management layer over the existing AMMs by:

- locking up LPT to mint synthetic assets that further reinforces liquidity in AMMs and Defi

- unlocking liquidity from existing AMM Liquidity Pools. The initial set of product Unbound has been built to include decentralized, cross-chain stablecoin called UND.

Key features

- Interest-free Loans

- Liquidation-Free Collateralization

- Cross-Chain Derivative Layer for AMMs across Multiple Blockchains

- DeFi Treasury for Liquidity Pool Tokens

- Truly Decentralized Cross-Chain Stablecoin

Unbound has undergone four security audits till now.

Audit 1: By Peter Kacherginsky

Audit 2: By Securings

Audit 3: By Lucash Dev

Audit 4: By Securings

All of them have reviewed the code of Unbound vaults for security vulnerabilities and successfully completed the audit.

Tokenomics

The UND is a stablecoin that is pegged to USD and collateralized by LPT (Liquidity Pool Tokens).

UNB is used for protocol governance, it’s a native token.

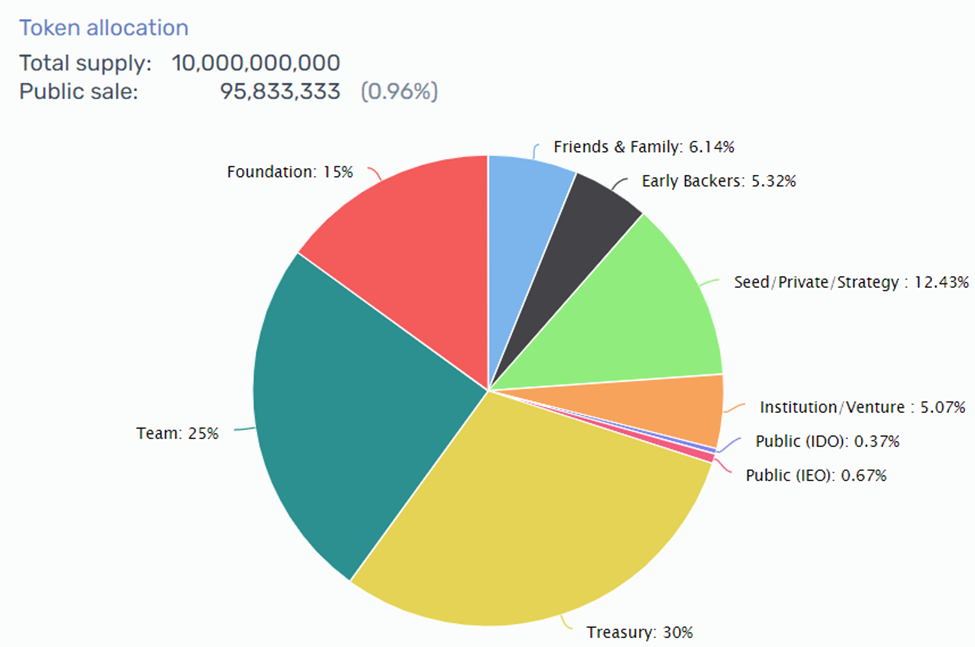

Total Supply: 10,000,000,000 UNB

Network: ERC20(ethereum)

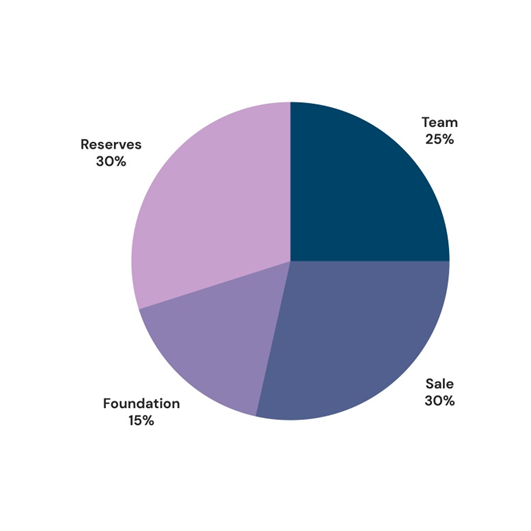

Token allocation

IDO IEO information

Listing on Polkastarter

- 13 DEC — 13 DEC 2021

- IDO price $ 0.012

- Hard Cap $ 200,000

- Lock-up 100% on TGE

- Tokens For Sale 16,666,667

On Gamefi

- 13 DEC — 13 DEC 2021

- IDO price $ 0.012

- Hard Cap $ 75,000

- Lock-up 100% on TGE

- Tokens For Sale 6,250,000

On Red kite

- 13 DEC — 13 DEC 2021

- IDO price $ 0.012

- Hard Cap $ 75,000

- Lock-up 100% on TGE

- Tokens For Sale 6,250,000

Primelist on Huobi

- 14 DEC — 14 DEC 2021

- IEO price $ 0.012

- Hard Cap $ 800,000

- Lock-up 100% on TGE

- Tokens For Sale 66,666,666

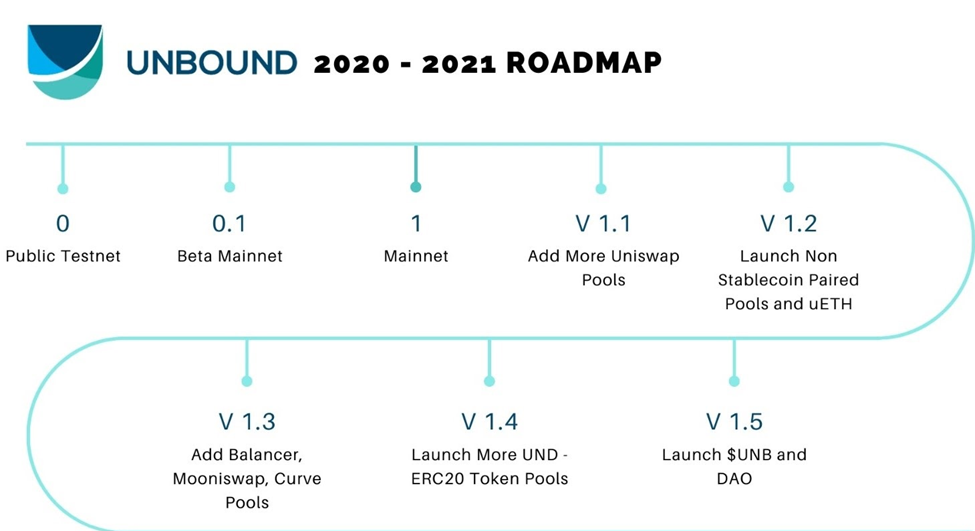

Roadmap

Investors and partners

They also made their partnership with Polygon, Kyberswap, Avalanche making it cross chain.