Table of Contents

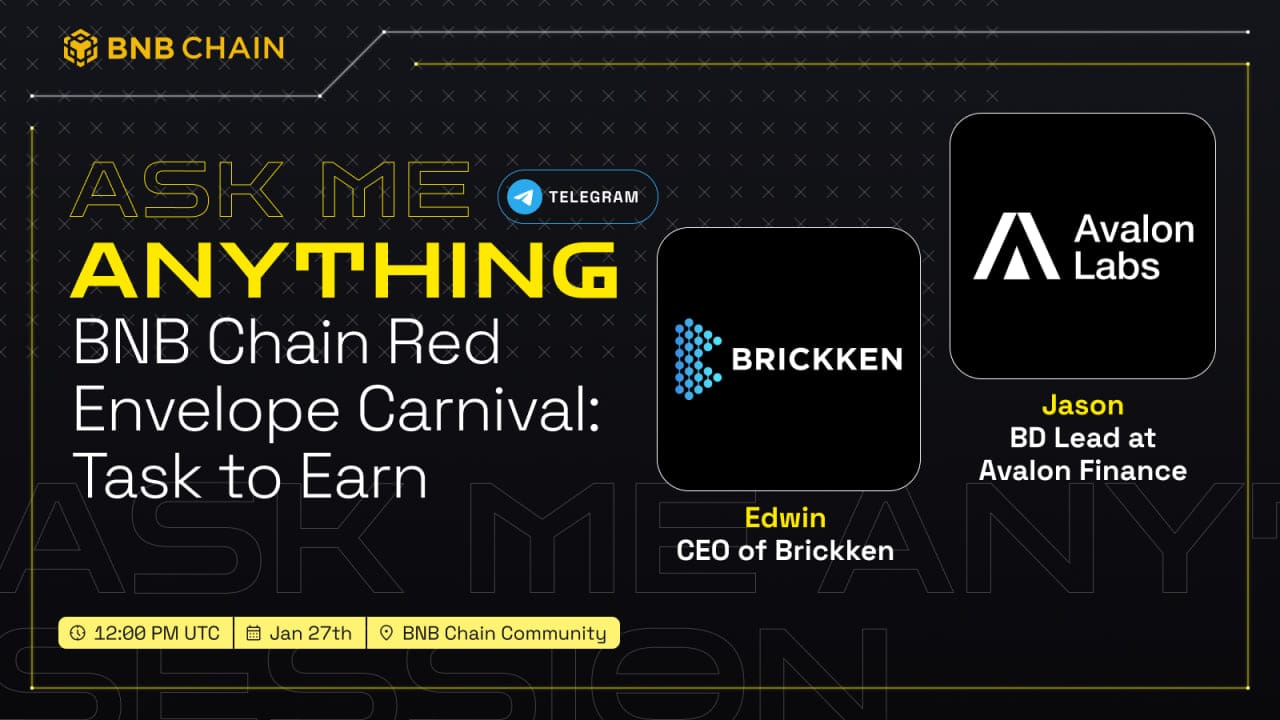

Q1. Please introduce you project and how it interacts with the BNB Chain ecosystem.

Brickken focuses on tokenizing Real World Assets (RWA) like equity, debt, and bonds, turning them into tradable financial instruments through our easy-to-use SaaS platform. We are the official tokenization provider for BNB Chain, supportingnbusinesses in securely and efficiently digitizing their assets. With over $250 million in tokenized assets across 14 countries, we leverage BNB Chain’s blockchain to offer scalable and compliant tokenization solutions. Our goal is to help companies access global investors and unlock liquidity while simplifying the tokenization process.

Q2. How does Brickken’s collaboration with BNB Chain as an official RWA tokenization provider enhance its ability to empower businesses with secure and compliant solutions, and what role does this partnership play in advancing global adoption of asset tokenization?

Brickken’s collaboration with BNB Chain as its official RWA tokenization provider strengthens our ability to deliver secure and compliant tokenization solutions by leveraging BNB Chain’s powerful blockchain infrastructure. Through this partnership, we also utilize BNB Greenfield, enabling decentralized data storage for enhanced efficiency and scalability, while tapping into BNB Chain’s global community to bring Real World Asset (RWA) opportunities directly to a broader audience.

This collaboration not only empowers businesses to digitize and tokenize their assets with ease but also gives the BNB Chain ecosystem access to innovative RWA investment opportunities, driving liquidity and adoption across markets. Together, we are advancing the tokenization landscape, bridging traditional assets with blockchain technology, and accelerating global adoption.

Q3. How does Brickken’s involvement in programs like PwC’s Scale Tokenisation and Digital Assets Programme and Circle’s Alliance Program shape its strategies for accelerating tokenization adoption, and what specific outcomes are anticipated from these initiatives?

Brickken’s involvement in PwC’s Scale Tokenisation and Digital Assets Programme and Circle’s Alliance Program is a pivotal step toward driving institutional adoption of tokenization. These programs connect us with key industry players, regulatory experts, and enterprise leaders, enabling us to refine our platform to meet the specific needs of institutions entering the tokenization space.

PwC’s program equips us with insights into how large-scale enterprises approach tokenization, helping us build solutions tailored to institutional requirements such as compliance, scalability, and risk management. Through Circle’s Alliance Program, we integrate fiat-to-crypto capabilities, providing the infrastructure needed for institutions to seamlessly transition into tokenized finance.

These initiatives are expected to accelerate the adoption of tokenization by enterprises, enabling them to digitize assets efficiently while building trust in blockchain-based solutions. Brickken is positioning itself as the go-to platform for institutions looking to embrace tokenization as part of their financial strategies.

Q4. What strategies does Brickken have in place to strengthen the BKN token economy, particularly through staking incentives and ecosystem integrations, and how will these efforts contribute to long-term growth and community engagement?

Brickken has developed strategies to strengthen the BKN token economy by focusing on utility and community-driven incentives. Through staking programs, token holders can earn rewards tied to platform activities, encouraging long-term engagement and alignment with Brickken’s growth. These staking incentives are not for supporting a network but rather to drive platform adoption and reward active participation in our ecosystem.

We are also enhancing the BKN token’s utility through integrations within our tokenization platform, where it serves as a means to access advanced features, pay for services, and participate in governance. Partnerships with other blockchain ecosystems and enterprises further expand the token’s relevance, creating new opportunities for use in Real World Asset (RWA) tokenization projects.

These efforts aim to build a sustainable token economy, fostering community engagement and supporting Brickken’s long-term growth as a leader in asset tokenization.

Q5. What strategies does Brickken employ to maintain a stable and helpful community environment on social platforms?

Brickken employs several strategies to maintain a stable and supportive community on social platforms:

- Active Moderation: Ensuring our community spaces are free from spam and misinformation, while encouraging respectful and productive discussions.

- Regular Engagement: Our team is highly active on Twitter and Telegram, interacting directly with the community, hosting AMAs, sharing updates, and responding promptly to questions to keep members informed and involved.

- Educational Content: Providing resources like guides, tutorials, and updates to help users understand tokenization and make informed decisions. Rewarding

- Participation: Incentivizing active engagement through programs like giveaways, contests, and exclusive opportunities for loyal members. Feedback

- Loops: Actively listening to community suggestions and incorporating feedback into our platform and strategies to ensure members feel valued.

Q6. What does Brickken consider the ideal ratio of institutional to retail investors within its platform, and why?

Brickken aims for a balanced ratio of institutional to retail investors on its platform, with an ideal split of about 60% institutional and 40% retail investors. This approach ensures stability and liquidity, as institutional investors typically bring larger investments and long-term commitment, which is crucial for scaling tokenized assets and attracting more projects to the platform.

At the same time, having a significant retail investor presence supports broader market adoption, decentralization, and community engagement. Retail investors bring diversity to the investment base and can benefit from the democratization of access to Real World Assets (RWA). This mix of investors creates a robust ecosystem where both large-scale and individual investors can participate in asset tokenization, driving liquidity and sustainable growth for the Brickken platform.

Q7. Is there anything you expect from the Red Envelope Carnival? For example, ecosystem activation, project promotion, etc.!

The Red Envelope Carnival presents a great opportunity for Brickken to achieve multiple goals:

- Ecosystem Activation: Events like these are excellent for driving engagement within the community, increasing awareness about Brickken’s platform, and introducing more people to the potential of Real World Asset (RWA) tokenization.

- Community Growth: We expect to attract new users and investors by showcasing how accessible and transformative tokenization can be, helping us expand our global reach.

- Project Promotion: Participating in the carnival allows us to highlight our achievements, such as over $250M in tokenized assets and collaborations with major partners like BNB Chain, and communicate our mission to a wider audience.

- Engagement with Retail Investors: The carnival offers a unique way to connect with retail investors, incentivizing participation and fostering their involvement in the Brickken ecosystem.

Q8. Please share your future plans!

At Brickken, our future plans are focused on scaling our platform, driving adoption, and leading the tokenization of Real World Assets (RWA) globally:

- SaaS Platform Growth: We’re evolving into a modular SaaS platform with enterprise-grade features like white-label solutions, API integrations, and automated tools. Our goal is to empower businesses to tokenize their assets quickly and efficiently, unlocking liquidity and opening new revenue streams. Strengthening $BKN

- Token Utility: We’re enhancing the utility of $BKN by integrating it deeper into our platform operations, offering incentives for its active use, and positioning it as a cornerstone of the tokenization ecosystem.

- Expanding Partnerships: While we already collaborate with industry heavyweights such as BNB Chain, Chainlink, PwC, Circle, and Cointelegraph, we aim to grow our network further by partnering with more financial institutions, enterprises, and blockchain innovators. These partnerships will enhance our platform’s capabilities, create new use cases for tokenization, and drive greater adoption among institutional and retail audiences alike.

- Innovations in Tokenization: From tokenized debt instruments and stablecoin integrations to AI-driven tools, we’re developing cutting-edge solutions to make tokenization smarter, faster, and more efficient for businesses and investors.

With over $250M in tokenized assets across 14 countries, we forecast surpassing $1 billion in tokenized assets this year as we continue to lead the future of tokenization.

→ https://brickken.com/links