What is Acala Network?

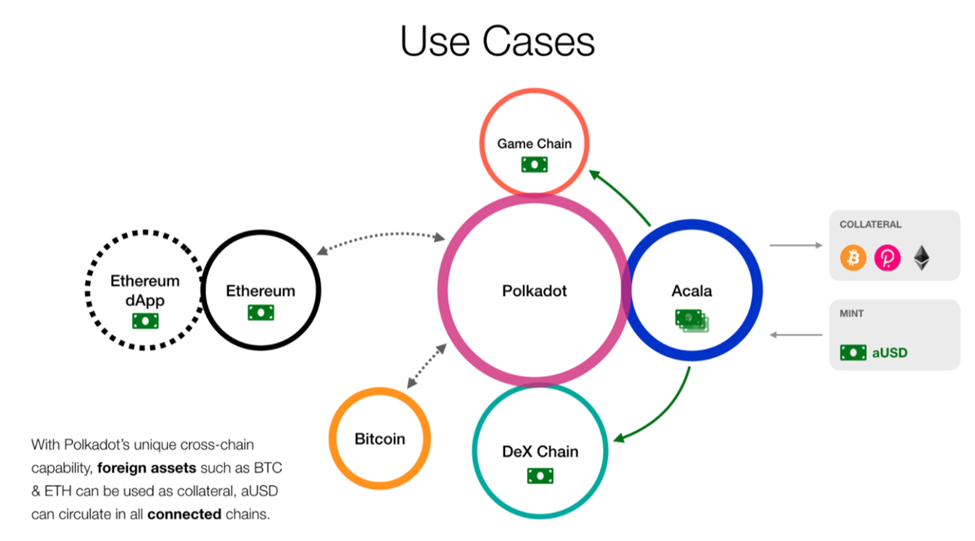

Acala is created to be a huge defi hub on Polkadot. It improves the scalability, low costs gas fee by using layer 1 smart contract platform and Ethereum Virtual Machine which makes it compatible with ETH network. One notable feature is the optimization for Defi with built-in liquidity and ready-made financial applications. Trustless exchange along with creation of decentralized stable coin (aUSD), DOT Liquid Staking (LDOT), and EVM+, Acala lets developers access the best of Ethereum and the full power of Substrate. Acala defines itself as a high-performance decentralized finance platform built as a Polkadot parachain. Founded by members of two Polkadot ecosystem teams, Laminar and Polkawallet, Acala brings a slew of decentralized financial services to Polkadot.

Striving to be the best economic hub of polkadot, Acala dives deep into the functions of Access DOT-based assets and derivatives, Polkadot-native decentralized stablecoin, Polkadot ecosystem assets, and cross-chain assets from Bitcoin, Ethereum and beyond. Besides that, the ability to make the compatibility with Ethereum is worth pay attention to, with Acala’s layer-1 platform offers the best of both Ethereum and Substrate environments. Compatible with established tech stacks, tooling, and wallets like MetaMask or Coin98.

Current DeFi applications face many problems concerning adoption from a mainstream audience, and much of these issues stem from the platform they’re built on. Unlike Ethereum, which requires gas fees to be denominated in ETH, Acala allows any blockchain platform to participate and pay for computation in any currency in what the team calls “Bring Your Own Gas.”

Tokenomics and token information

ACA is a native token of Acala Network which has 2 functions:

- Network utility token: a native fee token acts as a mean for transactions and smart contracts and also utilized the staking for collator, oracle and other networks activities.

- Governance of the network: provide holders with voting rights in Treasury governance, Council member election, referendum, network update, risk management,… adjustment of key risk parameters like stability fee, liquidation ratio, and collateral type.

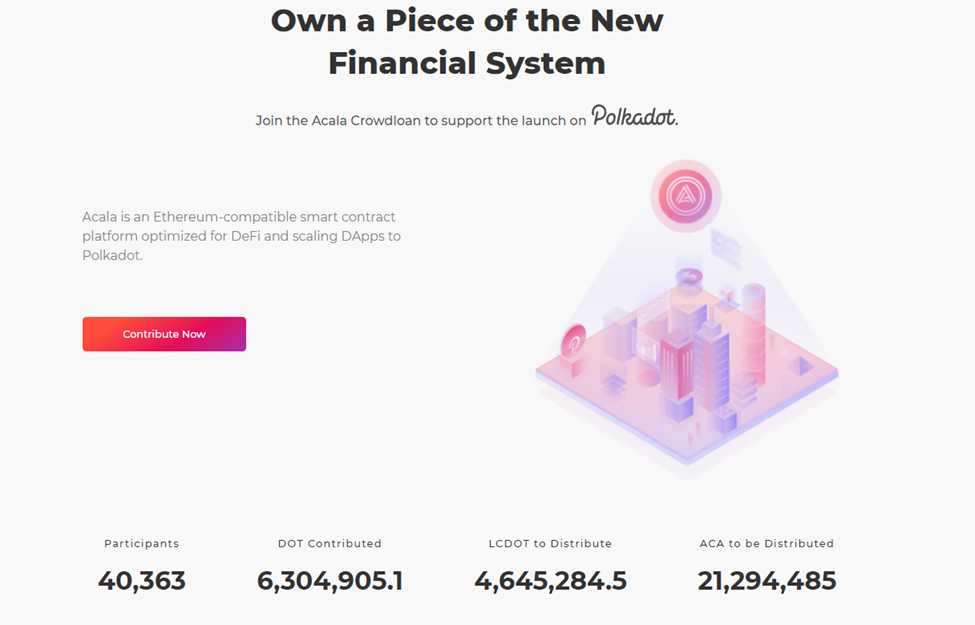

There’s not yet token listing on any exchange platforms but the token is not available in the market. The only way to buy it is through Acala Crownloan by locking up your DOT tokens to receive ACA as a reward. ACA might be locked for 2 years for all eligible allocations. 1 DOT can be exchanged to 3 – 24 ACA.

The total supply of the ACA Tokens will be minted at the launch of the mainnet and stored in the ACA Reserve Pool to be distributed to ACALA Foundation, Seed Investment Partners, IPO Participants as Reward, and the rest sold to the public.

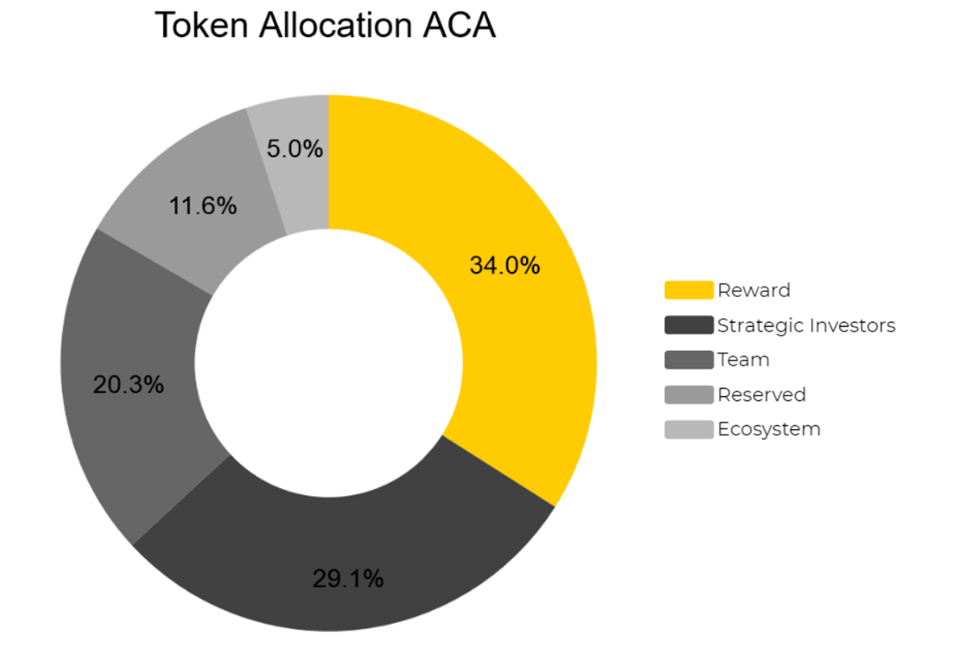

Token allocation

- Reward: 34%

- Strategic Investors: 29.13%

- Team: 20.25%

- Reserved: 11.62%

- Ecosystem: 5%

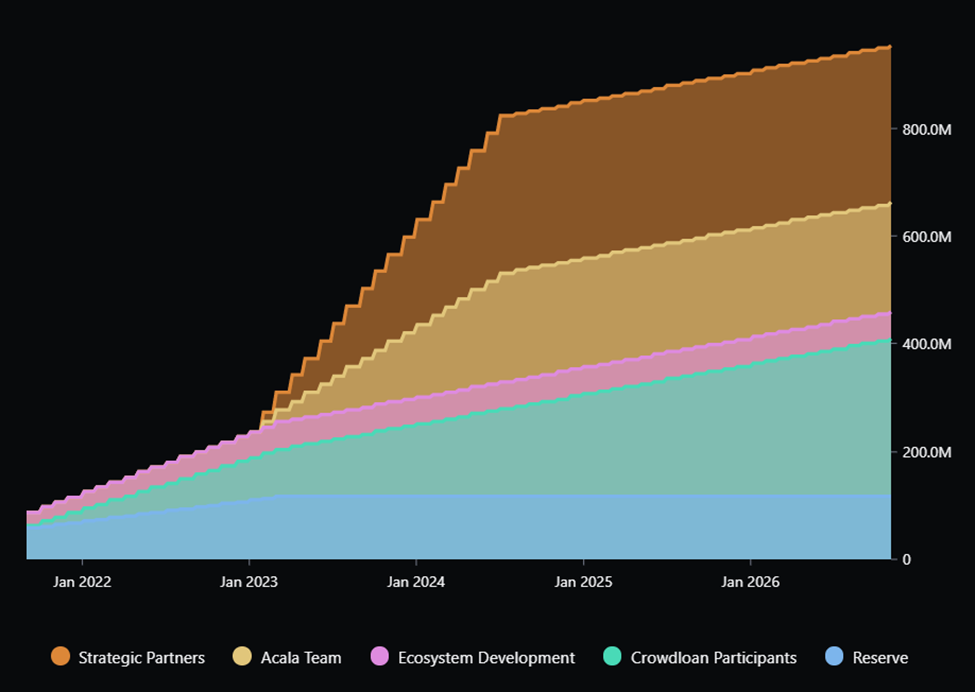

Release schedule

Recently in September 2021, Acala raised over $61M through the ICO event by more than 26,000 members around the world. The project also raised $7M in Series A through a simple agreement for future tokens (SAFT) sale and $1.4M in the Seed Round before the ICO.

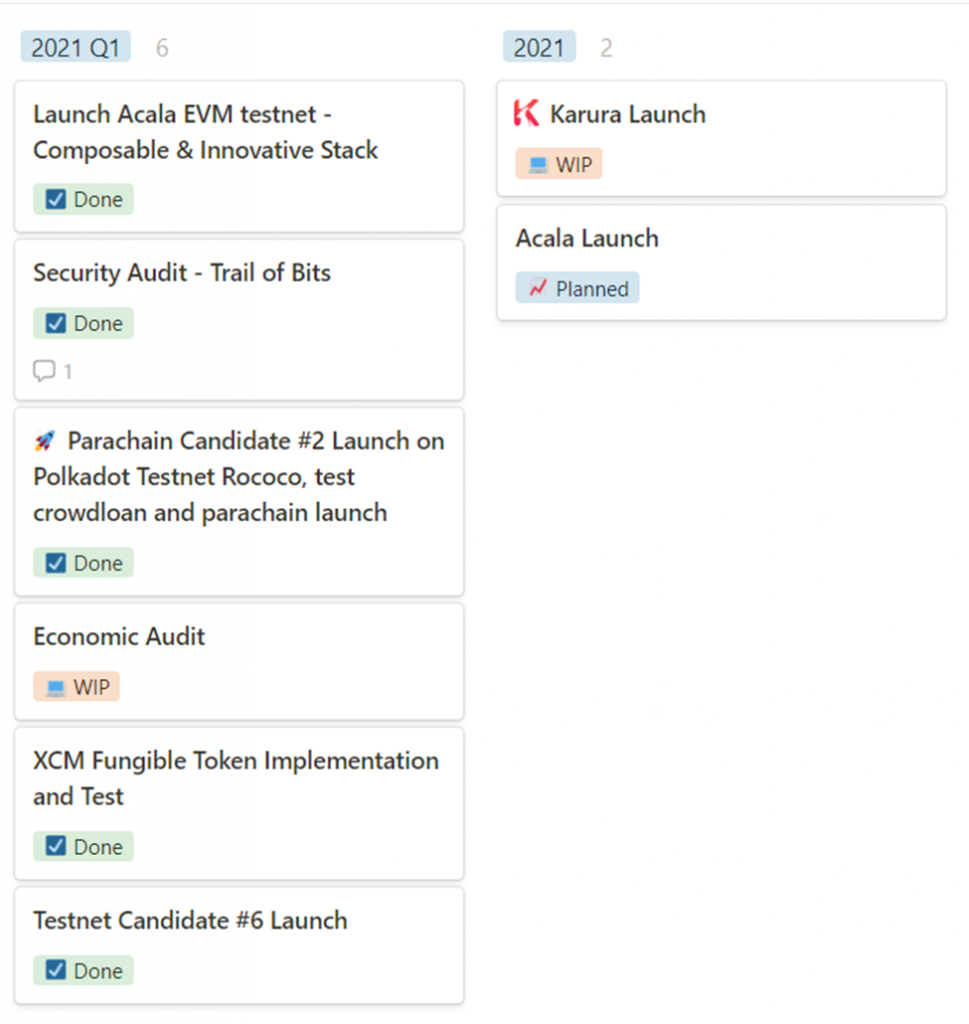

Roadmap

Started from Q3 2019 to 2020, Acala has done most of their important updates, which now leads to 2021:

2021 Q1:

Launch Acala EVM testnet, Composable, Innovative Stack

Security Audit – Trail of Bits.

Parachain candidate #2 Launch on Polkadot testnet Rococo, test crownloan and parachain launch.

Economic Audit

XCM Fungible token implementation and test

Testnest candidate #6 launch.

2021

Karura launch

Acala launch

Key Features of Acala

Powered by the advanced Polkadot’s Substrate framework, Acala will be able to host the Homa liquidity staking protocol and the Honzon stablecoin creation protocol on the Polkadot parachain. The network also accepts other wrapped assets such as renBTC as collateral to mint its stablecoin (aUSD). Details of each component in the network will be explained in this part.

Parachain crowdloan

The network will be launched on DOT with a Crowdloan to bid for a parachain lease. The auction has been set up so that bidders can deposit their DOT tokens in order to support the project, and if successful they can get rewarded proportionately.

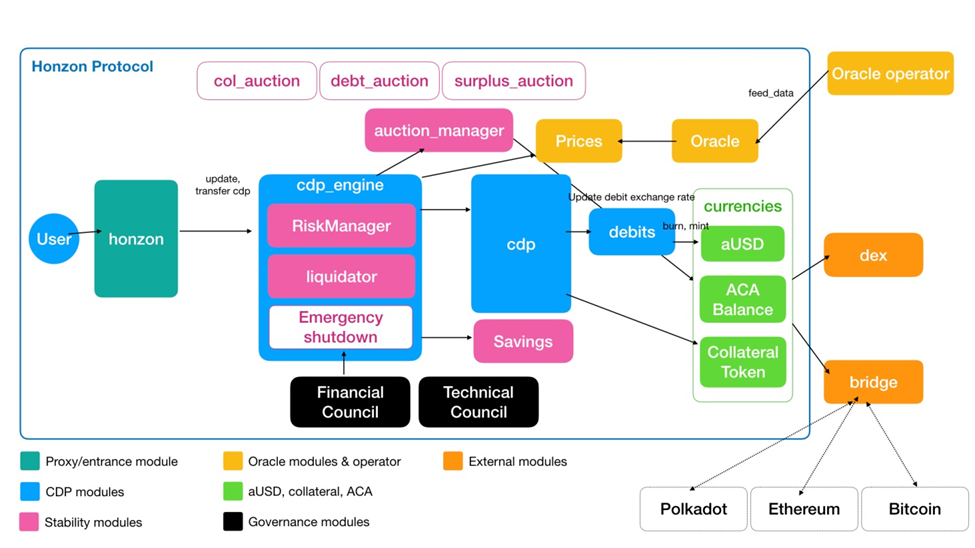

Honzon protocol

It’s basically a to make easier access for people to crypto world through creation of a stablecoin that’s both easy-to-use and backed through Collateralized Debt Positions (CDPs), the protocol will be able to accept collateral assets from multiple blockchains. That way people can learn quickly to access the defi world. The Acala stablecoin such as aUSD is pegged to USD at a 1:1 ratio, this architecture will enable crypto users to take out of aUSD by depositing digital assets in the network. However, users are required to pay an interest fee on each loan they are committing to.

The efficiency will be greatly increased by using Chainlink together which allows decentralized pricing data feeds on Acala to be maintained and risk-free.

Homa protocol

Homa Protocol is designed to create liquidity from locked assets on the Acala Network. With traditional yield-farming, any locked assets are usable in order to receive interests. However, with Homa Protocol, users are able to participate in Yield Farming and use that locked assets for other activities for higher rewards as well as diversifying investments. Locked assets will be returned as an L-token. For example, when you deposit DOT tokens, you will receive L-DOT in return and L-DOT can be used for different purposes such as collateral to mint aUSD to supply for borrowers as a loan.

EVM compatibility

The Acala system will allow developers to create applications written in Solidity and mint assets that function similarly to ERC20 tokens. Cross-chain transactions such as renBTC or aUSD are all compatible with Acala at launch. Any on-chain action within the EVM will be translated into Substrate code for Polkadot extensions like oracles who provide price feeds so interactions can happen seamlessly between chains without intermediaries

Stablecoin

The expanding of scaling solution, and interoperability with other networks and ecosystems have left the team with the idea of creating their own Acala Stablecoin (aUSD). It serves as a mean for better security, cross-chain capability, and multi-collateral backed.

Team and partners

Team

The team mainly comprises of software engineering and blockchain tech background with a very few working as financial advisors and marketing. Most of them come from Laminar and Polkawallet which are the cross chain wallet with staking feature and finance platform with synthetic assets and margin trading.

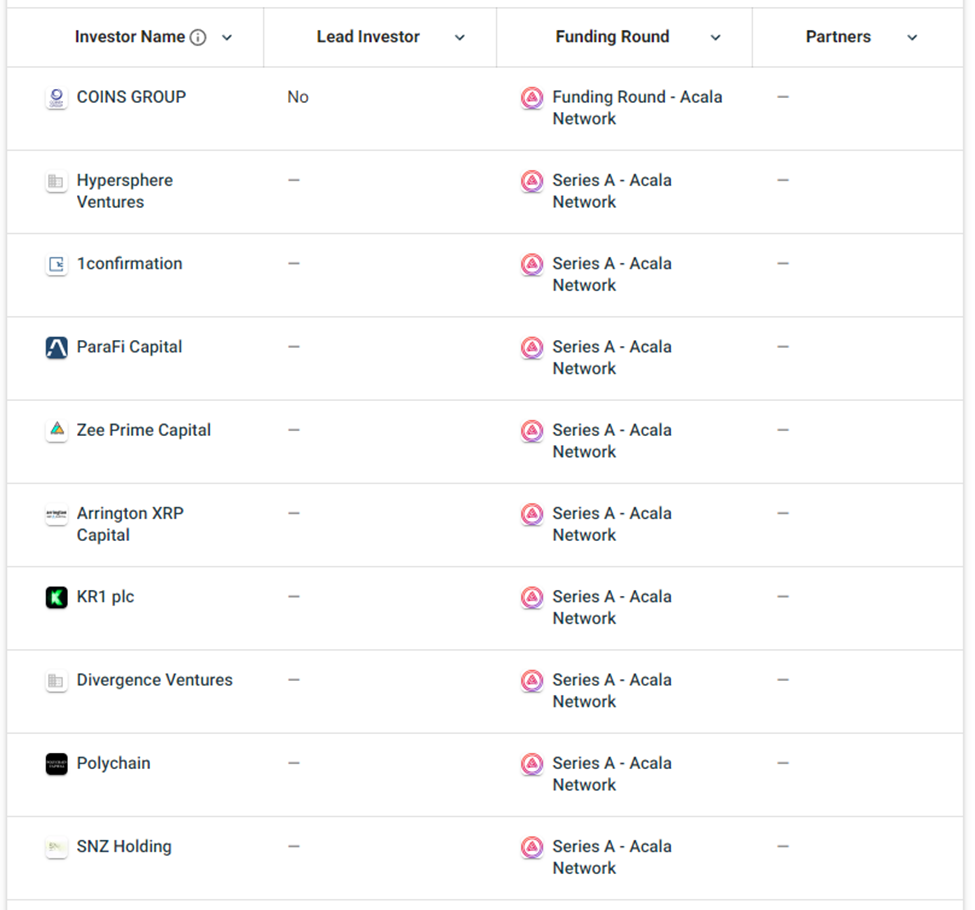

Investors

Funded by many reputable investors, including Parafi Capital, Polychain, and Arrington XRP Capital in the list, Acala surely is one of very first new defi project on DOT but it has attracted a lot of popular investors.

Partning with various projects across several categories to accelerate the development of the network. A whole list is mentioned on their website (6-9-2020), some of which are: Polychain, P2P Capital, HashKey Capital, DCG and KR1. Participated in the DeFi Alliance’s accelerator program (18-9-2020).Is a partner of Zenlink according to its website (11-11-2020). Also in the lastest raise of $7M in 2020, an agreement for future token (SAFT) led by Pantera Capital.

About the project

Disclaimer: this’s based on write’s perspective, not a financial advice.

Acala defines itself as a high-performance decentralized finance platform built as a Polkadot parachain. Founded by members of two Polkadot ecosystem teams, Laminar and Polkawallet, Acala brings a swing of defi services to Polkadot, including a decentralized exchange (DEX), staking liquidity (Liquid DOT (LDOT)) and even an algorithmic stablecoin, aUSD. Acala is both a parachain platform on which other teams can build on, as well as an application layer providing a suite of applications offering the aforementioned financial products.

Claimed to solve to the problems of current defi which are high gas fee, quick transactions and more features, Acala emphasizes on its micro gas fee and parachain features. Acala is slowly but surely solving the gas fee inflation and network congestion problems faced by decentralized applications built on Ethereum. Additionally, since the platform used to design Polkadot, Substrate, is capable of parsing any language that compiles to WebAssembly, it’s much easier for developers to try their hand at creating an app.

Solidity is Acala’s approach to development in the long run, with deploy of custom-built Acala EVM, a novel contribution to the Polkadot ecosystem that gives a seamless, full-stack experience for Solidity, Substrate and Web3 developers. This way, developers on Acala get the benefit of the EVM environment, without sacrificing the power of Substrate. There hasn’t been any notable information about its tokenomics so the main takeaway here is what the network can do. Being compatible with ETH network by using EVM, this is a future for serving convenience for users bridging Eth and DOT. Even before the auction on Parachain, the project has gained a lot of confidence from the community, signifying that there are a substantial number of users that are supporting it. Gaining an official position on the parachain would be a significant step for the development of the project. The multi-collateral Type CBD that Acala Network offers is similar to the concept of MakerDAO. However, the assets are not limited to the DOT’s native tokens, many digital assets from other blockchains and ecosystems such as ETH and BTC are also supported. This approach will quicken the use cases of the Acala Network even more in the future where many projects will operate on their own blockchains.