Table of Contents

Updated Aug 1, 2025

Special thanks to Securitize and Backed Finance (xStocks) for their review.

Tokenizing real-world stocks compresses two-day settlement cycles into seconds, enables programmable assets, and unlocks 24/7 global trading. Yet the sector remains small—roughly $370 million compared to $120 trillion in global equities.

This blog explores:

- Key design considerations for security tokens;

- Best practices and standards on BSC/EVM chains, with protocol examples;

- Opportunities for improvement in compliance, infrastructure, and liquidity.

We’ll break down what’s live today, the regulatory roadblocks, and how tokenized stocks could grow 10× by 2026.

1. Mechanism of Tokenized Stocks

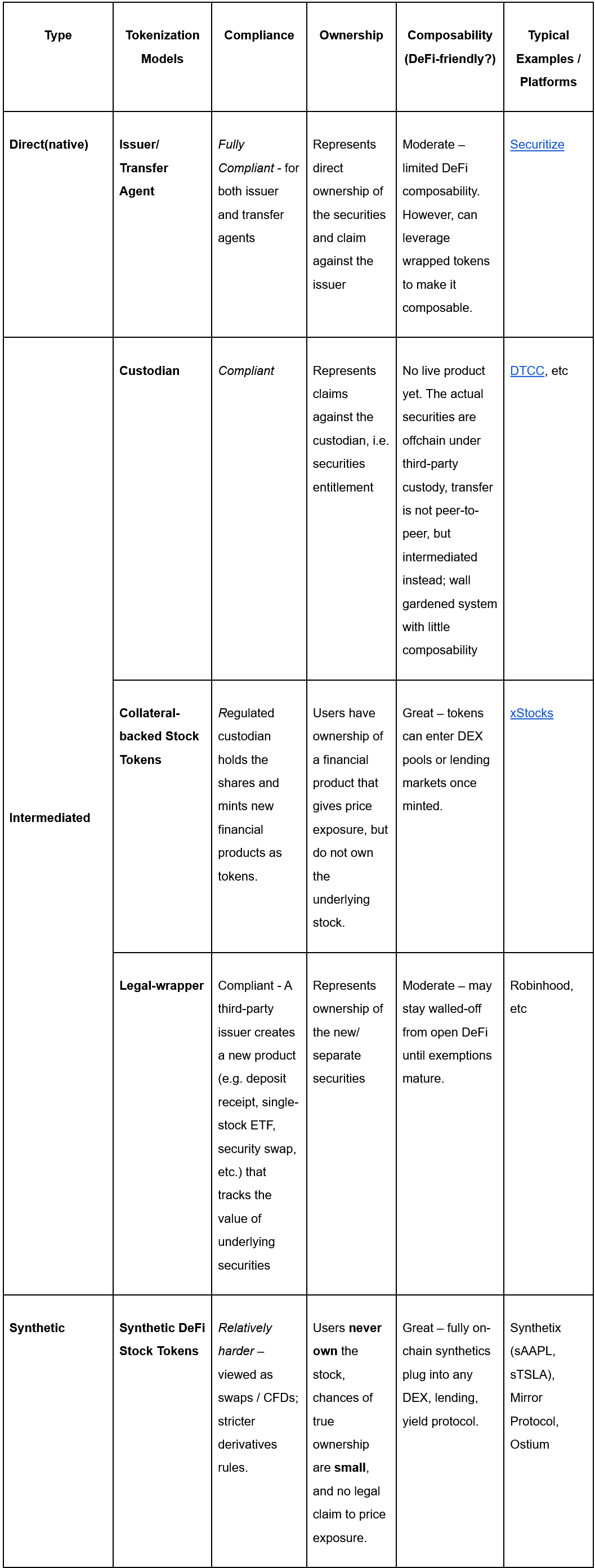

Stock token designs span a spectrum: on one end, compliant custodial wrappers offer only price exposure with limited DeFi utility; on the other, fully composable on-chain synthetics maximize DeFi access but confer no real shareholder rights and face stricter derivatives regulation. As mentioned in various discussions:

2. Market Snapshot

- Tokenized‑stocks TVL: $370M across 167 assets (RWA.xyz).

- xStocks volume: Daily $134M (Coinmarketcap).

- Market Potential: If just 0.002% of global equities are tokenized by 2026, the market could reach ~$3B. While still nascent, tokenized equities are showing early signs of traction—and the room for growth is massive.

3.The Tokenized-Stock Trilemma

Token issuers must juggle three goals that pull in different directions:

| Pillar | What “full” means | Why it matters | What breaks when you maximize it |

| 1. Compliance (KYC · securities registration · on-chain transfer controls) | Every jurisdictional rule is met; only whitelisted wallets can mint, redeem, or receive tokens. | Fully regulated and enables CEX listings or institutional inflows. | Tight KYC gates or transfer hooks restrict how—and where—tokens can move, limiting DeFi utility. |

| 2. Ownership (redemption, dividends, voting rights) | Token legally represents the underlying share; holders can redeem, receive dividends, and vote. | Delivers the same economic & governance rights as legacy shares. | Legal wrappers and corporate-action pipelines add cost and slow settlement; KYC is usually mandatory, curbing composability. |

| 3. Composability (permissionless liquidity, DeFi integrations) | Token flows freely across DEXs, lending pools, structured-yield protocols, bridges, and DAOs. | Unlocks 24/7 trading, collateral use, and on-chain financial engineering. | Wide transferability clashes with strict KYC; regulators balk, so most projects strip out voting/dividends or rely on synthetics. |

Core insight: a design can excel at any two pillars, but the third will be compromised:

- Compliance + Ownership → tokens sit in a closed, KYC-walled environment with little DeFi reach

- Compliance + Composability → wrappers trade freely but only give price exposure (no voting).

- Ownership + Composability → would deliver “real shares in DeFi” but currently clashes with most securities laws.

4. Compliance Implementation

Bringing real-world equities on-chain is impossible without robust identity controls. Today every live product relies on one of two whitelisting mechanisms:

| Whitelisting Model | How It Works | Strengths | Trade-offs |

| Smart-Contract Registry(on-chain) | Each time someone calls transfer() or mintTo(), the token contract pings an Identity Registry. If either wallet lacks a valid credential, the transaction reverts. On EVM chains this pattern is formalised in ERC-3643. | Entire permission set lives on-chain; no central key can override it; portable across dApps. | Adds gas / compute; Devs must deploy and maintain the registry; UX friction (wallets must obtain credentials). |

| Custodial Control(off-chain gate) | A single regulated entity controls the mint/burn keys. Only KYC’d customers can deposit fiat (or shares) and receive tokens from the custodian’s treasury wallet. Once minted, tokens may—or may not—circulate freely. | Simpler compliance checklist; No extra on-chain logic; Fast to iterate. | Creates a choke-point; users depend on the custodian’s uptime and legal domicile; |

Smart-Contract Registry in Action

ERC-3643 (initially known as T-REX) illustrates the on-chain model:

Every transfer runs isVerified(). Securitize uses the same logic, even if its contracts don’t formally signal ERC-3643 compliance. When users transfer tokens, the preTransferCheck will be executed to see if the receiver is on the registry.

https://etherscan.io/address/0x9e2693f54831f6f52b0bb952c2935d26919a3626#code#F18#L51

Registry is designed to allow registered investors by wallet address.

https://etherscan.io/address/0x9e2693f54831f6f52b0bb952c2935d26919a3626#code#F36#L18

Custodial Control – The xStocks Case Study

xStocks show how a single entity can satisfy regulators and still issue tokens that are usable in DeFi once minted. The “Trust Stack” Behind CRCLx (Circle Tracker Certificate):

| Layer | Role | Detail |

| Real-Asset Layer | Asset Reserve | Alpaca Securities LLC holds real Circle shares 1 : 1.Chainlink oracles publish live proof-of-reserve. |

| Legal-Wrapping Layer | Issuer Entity | Backed Assets (JE) Ltd. – a Jersey SPV – legally owns the shares and issues tracker certificates. |

| Tokenization Layer | On-Chain Financial Product | Backed Finance AG mints CRCLx (SPL) on Solana – the token is the tracker certificate. Token creator ID: S7vYFFWH6B…VwsJuRaS (view on Solscan). |

Ownership reality: CRCLx is a tracker certificate—holders get price exposure, and have the primary claim to the collateral value. They do not have voting rights, but dividends and splits are managed via rebasing.

| Phase | Who Must KYC? | Where Tokens Can Go |

| Primary (Mint / Redeem) | Only pre-approved institutions or professional investors. | Tokens minted/burned inside Backed custody. |

| Secondary (DEX Trading) | Freely transferable tokens. Anyone can LP or trade once CRCLx hits the pool. | Easily used across DeFi. |

Result: xStocks reconciles the regulator’s need for strict KYC at the capital-formation edge with DeFi’s demand for permissionless liquidity after issuance.

5. Potential Challenges

- Regulatory Fragmentation Securities rules, KYC standards, and custody requirements differ sharply across the U.S, EU, Asia, and offshore hubs—forcing issuers to geo-fence users or launch multiple wrappers.

- Ownership vs. Compliance Trade-off Granting full shareholder rights (dividends, voting) triggers stricter securities treatment; most projects settle for price-tracker certificates, limiting investor appeal.

- Corporate-Action Plumbing Stock splits, mergers, and dividend events must update token supply and metadata in real time; today this is still a manual—or at best semi-automated—process prone to error.

- Proof-of-Reserve & Custody Risk Tokens are only as trustworthy as the oracle showing that real shares remain in custody; stale data or a custodian failure undermines the entire instrument.

- UX Friction Around KYC On-chain registry checks (ERC-3643 style) add gas cost and onboarding steps, while off-chain custodial gates break composability—both hurt adoption.

Together these hurdles explain why only 0.0003 % of global equities are on-chain today despite clear demand for 24/7, programmable trading. But, with new solutions arising, there is rapid growth potential for tokenized stocks.